Net Zero Technology: Innovation Priorities 2025-2035 | May 2025

Technology focus areas

The following technology focus areas are featured in this report:

Offshore Renewables and grid

Strategic Imperative

Offshore marine renewables, such as floating offshore wind (FOW), wave and tidal energy, are key technologies which are particularly suited to the United Kingdom Continental Shelf (UKCS). They have the potential to harness vast untapped marine resources providing a reliable, domestically produced source of renewable energy. The UK has the greatest potential offshore wind resource in Europe, estimated to be greater than the next five European countries’ resources combined.

The UK is in an unparalleled position to gain first mover advantage in emerging offshore marine renewables and cement our status as a global leader in offshore renewables. As well as abundant natural resources, the UK’s existing energy supply chain capabilities provide a strong base upon which to build further on the flourishing offshore renewables industry. The FOW market in the UK is estimated to have a gross value add (GVA) impact of £47 billion to the UK economy, with a global market worth £1 trillion by 2050. Of the UK’s future FOW market, 57% is expected to be addressable by existing UK oil and gas supply chain firms.

The UK has nearly 15 GW of offshore wind installed around its coastline with ambitious plans to expand both fixed-bottom and FOW projects to over 50 GW by 2030, at least 5 GW of which to be floating. This growth is supported by substantial national and devolved government backing with FOW presenting a significant opportunity for expertise and skills transfer from the existing oil and gas supply chain.

As well as technical innovation to access these offshore resources, significant innovation to reduce the levelised cost of electricity (LCOE) to £100/MWh by 2030 and £70/MWh by 2050 will be needed to unlock an affordable net zero energy system for the UK.

To facilitate the development of offshore renewables a rapid expansion of the offshore grid network is required with an estimated additional 4,500km that must be built by 2030 – more than double what has been built in the past 10 years. And as the expansion of offshore renewable energy generation continues, so too will levels of curtailment as the grid attempts to manage the variability of the energy sources.

This level of curtailment is having a significant negative impact on growth of the sector. Technology innovations are central to solving this and ensuring the maximum resource recovery of offshore renewables. Applying the latest AI-based algorithms and analytics in tandem with innovative storage technology deployment can significantly help the UK secure an early advantage in this emerging sector and deliver innovative solutions to reduce costs.

The Economic and Commercial Opportunity

The UK has some of the best resources for offshore renewable energy in the world. The practical resource from floating offshore wind is over 1,500 TWh per year – over four times projected future electricity demand. Meanwhile, the UK has over 30 GW of untapped tidal and wave energy capacity, enough to provide over a third of its electricity demand.

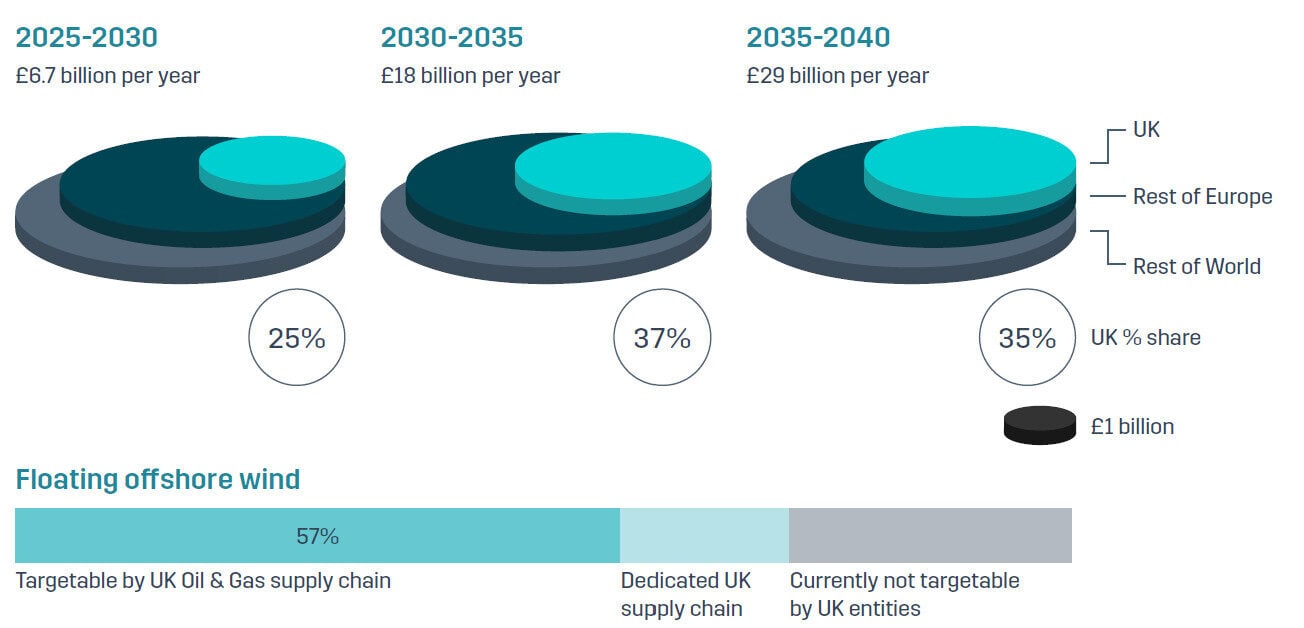

Analysis by Rystad for Offshore Energies United Kingdom (OEUK) forecasts that annual expenditure in the UK floating offshore wind market will average £10.1 billion per year from 2035 to 2040 representing 35% of the global market and providing significant export potential for the UK supply chain. Of this market, 57% is expected to be addressable by existing UK oil and gas supply chain firms. This is shown in Figure 7.

Source: Rystad Energy (2024) ‘UK oil and gas supply chain and opportunities in the energy transition’. Reformatted by NZTC

It follows that the UK is well placed to take first mover advantage in the offshore energy market. However, it could miss out if an acceleration in deployment is not achieved and the UK’s target of 5GW of FOW capacity by 2030 is at risk. At today’s rate, the UK will only have 2 GW deployed in 2030, reaching the 5 GW target in 2033.

To make this a reality reducing the levelised cost of electricity (LCOE) of floating offshore wind is essential. The current LCOE of FOW is higher than fixed but with the right investment and innovation, the LCOE of FOW is expected to follow the same cost reduction curve as fixed wind.

Reducing costs through innovation, industrialisation and scaling of manufacturing, supported by dependable market demand and deployment could achieve a contract for difference price of £100/MWh by 2030 and below £70/MWh by 2050. The NZTC programme is ready to deliver this at pace with our partners.

Delivering the Technology Opportunity

There are three fundamental challenge areas that need to be addressed to deliver the offshore renewables and grid opportunity; scale, integrate and transition which are detailed in Figure 8 below:

A focus on innovation is central to the success of the programme which will reduce costs, accelerate deployment and integrate with the grid and other growth areas such as low carbon hydrogen and carbon capture. This in turn will maximise the potential of an integrated offshore energy system. By accelerating new innovative solutions and leveraging the latest digital technologies the programme seeks to ensure that the UK remains a global leader in offshore renewables development and to transition our existing supply chain to new green jobs and will apply all four of the NZTC programmes.

With challenge comes opportunity and NZTC has identified a number of key areas within each of these challenges that will deliver cost reductions and value to the sector. These range from the opportunity to demonstrate and accelerate emerging digital technologies through a living lab, to undertaking deployment trials to prove the transferability of major equipment from existing offshore sectors into renewables such as subsea power cables.

An outline of the initial opportunities that NZTC has identified for further exploration is given in Figure 9 below. These have been built and identified through strong industry engagement to reflect the areas of opportunity that can deliver maximum impact. As the programme is built out into delivery these opportunities will be tailored to meet our key stakeholder and industry challenges.

Let us know what you think of the opportunities we have identified.

Scan the QR code to provide your comments or suggestions or email us at [email protected]

Example Project

An example project for development as part of the renewables and grid programme is the delivery of an offshore living lab, categorised as a Technology Trials programme. The living lab would provide a test bed for emerging digital and sensor technology from the blade tips to the subsea export infrastructure.

The data collected from the living lab will enable digital models to be simulated in a range of potential scenarios providing a rich data source for international benchmarking.

Joint Industry Programme

Floating Offshore Wind Innovation Network + WINTOG Network

In partnership with ORE Catapult and responding to the INTOG leasing round, these two joint industry programmes examine common industry challenges at a project level, designing and delivering work that will address the key issues.

Overview: With the Floating Offshore Wind Innovation Network, NZTC is supporting maximising both the

impact of pre-commercial, pilotscale, innovative floating wind projects to drive down costs for

future commercial deployments (Innovation Network (INTOG) and maximising the impact of the ‘Targeted Oil and Gas’ (WINTOG) projects for the energy transition and cost reduction.

Outcomes: The JIP’s are underway at time of writing, jointly progressing. Almost all those who successfully

received a licence under the Crown Estate Scotland leasing round in 2023 are engaged in these projects.

Hydrogen and Alternative fuels

Strategic Imperative

The energy sector is undergoing unprecedented change as countries set out their strategies for global decarbonisation. There is an urgent need for versatile and transformative energy vectors to support this. Low carbon hydrogen is recognised as one such vector. It has the potential to decarbonise hard-to-electrify industries such as heavy transport and heat-intensive industries whilst providing critical energy storage capacity to overcome challenges with intermittency in renewables.

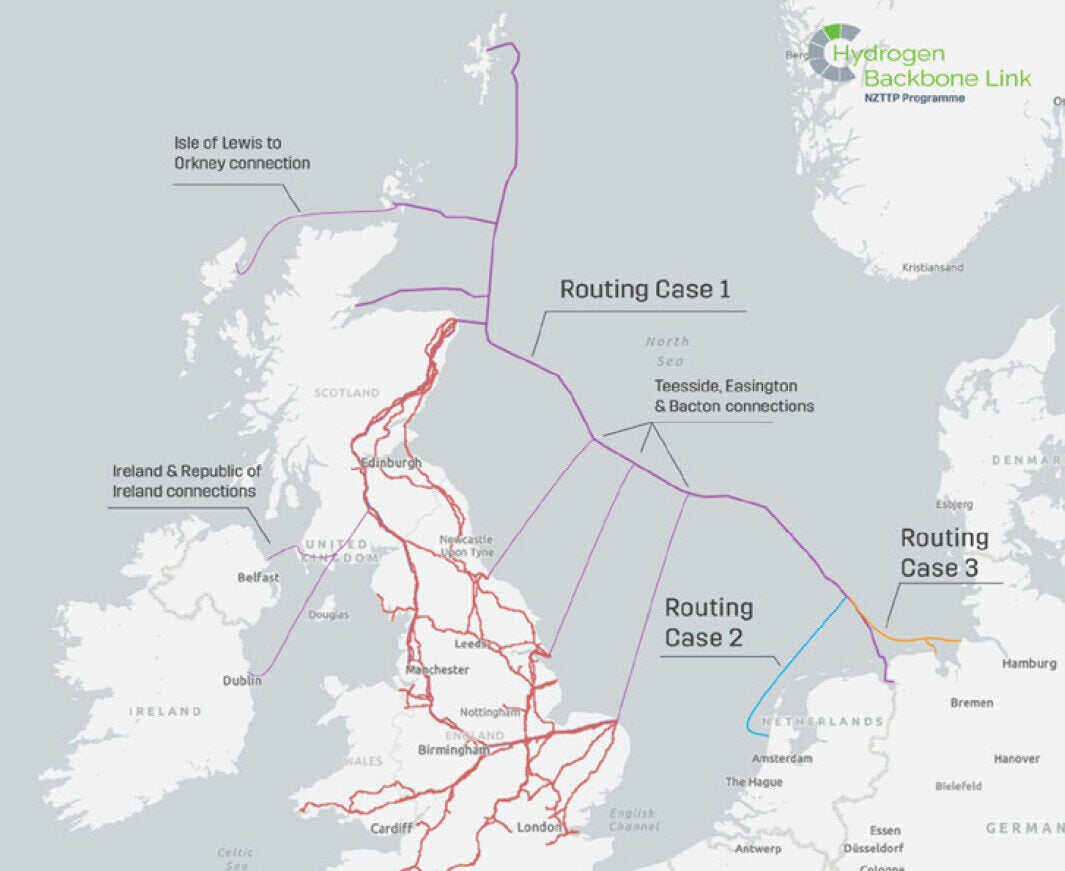

At present, the UK currently has 9.5 MW (or 1.5 kt per year) of operational low carbon hydrogen production capacity and a project pipeline for 2030 which would see build-out reach 11 GW (or 4.7 Mt per year), exceeding the current 10 GW target. With domestic build-out on target, the UK also has the opportunity to drive forward the hydrogen export market.

With neighbouring markets in Europe and a geographical position that lends itself to acting as a gateway for many international opportunities, the UK has a unique opportunity to be a cornerstone of an integrated international hydrogen network.

Hydrogen is also a key feedstock for all synthetic or alternative fuels (e-fuels) including synthetic methanol, methane, ammonia, petrol, diesel and aviation fuel. Synthetic fuels are fuels which are created from sustainable feedstock such as green hydrogen and captured CO2. They are engineered to replicate the qualities and energy content of standard fossil fuels such as gasoline, diesel and natural gas.

e-methanol, for example, is emerging as an early transition fuel for the marine sector. At the time of writing, the Methanol Institute is tracking 178 renewable and low carbon methanol production projects globally with a predicted combined output of 37.7 Mt by 2030.

However, only one of these projects is located in the UK. With existing transferrable skills and infrastructure, the UK can, and critically should, play a key role in the build-out of this emerging sector.

To reduce the levelised cost of hydrogen (LCOH) to <€2/kg by 2035 we must apply existing skills and expertise with a fundamental focus on innovation and delivering infrastructure at an industrially relevant scale. This can unlock up to 460 TWh/yr of hydrogen production by 2050, delivering domestic energy independence and realising global export opportunities and contributing to the UK ambition of supporting 30,000 direct jobs and delivering £7 billion+ GVA annually by 2030.

The Economic and Commercial Opportunity

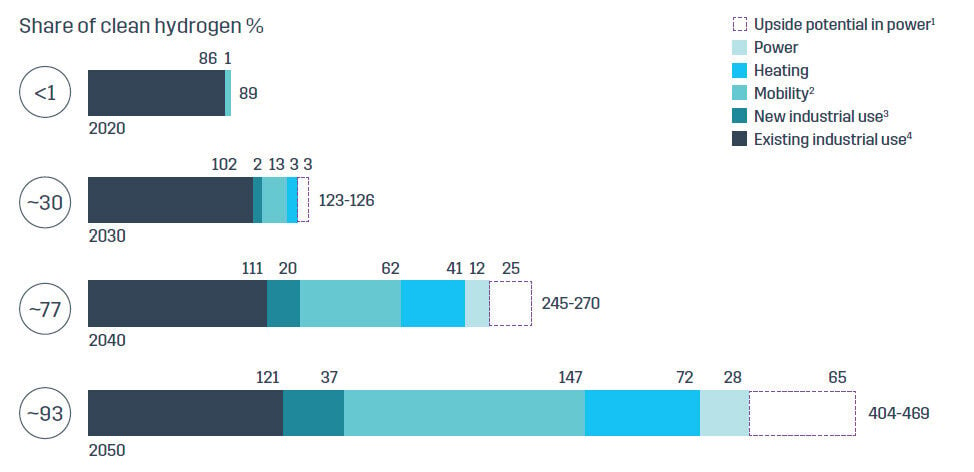

Hydrogen is an emerging energy source for many global industries and a key feedstock for other energy vectors such as e-methanol and green ammonia. McKinsey predicts that by 2050 global hydrogen demand could reach 469 Mt per year, more than quadrupling 2020 production as shown in Figure 10.

1 Upside potential in power estimated to account for 0-1% in 2035 and 1-3% in 2050 of the gross generation in different regions. Actual development could be affected by different drivers such as cost reductions, government targets, support schemes, etc.

2 Including maritime, aviation and trucking.

3 Iron and steel production via H2-DRI-EAF route.

4 Refining and chemicals (ammonia and methanol production).

Source: McKinsey (2024), ‘Global Energy Perspective 2023: Hydrogen outlook’. Reformatted by NZTC

Fertiliser production and chemical refining are likely to take the lead in the uptake of clean hydrogen to 2030 when steel, production of synthetic fuels and heavy road transport will begin to emerge.

The UK Government’s Hydrogen Strategy estimates that in 2050 between 20% and 35% of the UK’s final energy demand could be met with low carbon hydrogen. Hydrogen UK’s most recent Economic Impact Assessment estimates that the hydrogen sector in the UK could support approximately 30,000 direct jobs and contribute more than £7 billion GVA annually by 2030.

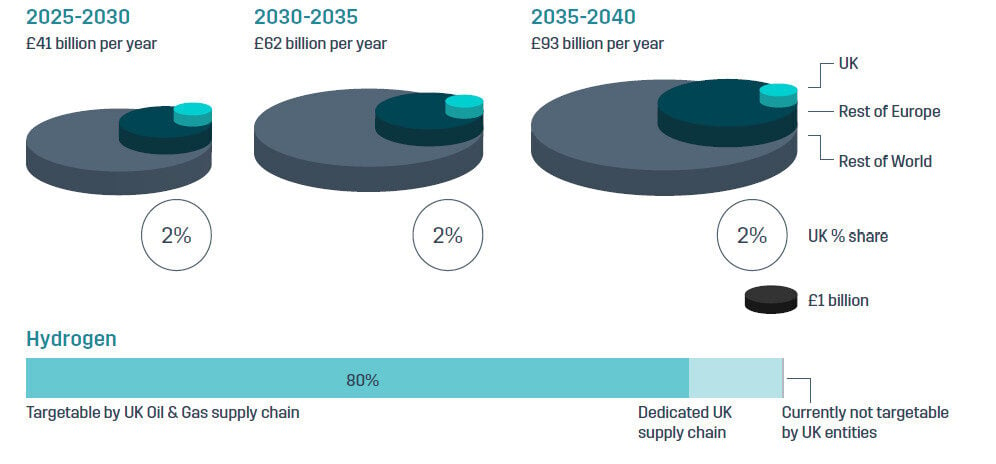

Analysis by Rystad for OEUK forecasts that annual expenditure in the UK hydrogen market will average £1.9 billion per year in the period 2035-2045, representing 2% of a global market total of £93 billion per year, offering significant export potential for the UK supply chain. Of this market, 80% is expected to be addressable by existing UK oil and gas supply chain firms. This is shown in Figure 11.

Rystad estimates that the global addressable market for the UK supply chain is £590 billion between 2024 and 2040. As pioneers of the UK’s international hydrogen opportunity coupled with our deep energy sector partnerships, NZTC is ideally positioned to address these opportunities.

When considering synthetic and alternative fuels, the UK SAF mandate will increase the demand considerably over the next decade. Beginning in 2025, 2% of total UK jet fuel demand will need to come from SAF, increasing to 10% in 2030 and then to 22% in 2040. This results in a SAF demand in 2030 of 1.2 Mt, double the current production capacity of the UK. With the UK poised to be a first mover in SAF adoption, it is essential that we harness the existing resources throughout the UK from an energy and skills perspective to benefit from this implementation.

In addition to the UK having a clear mandate for decarbonisation of the aviation sector, the EU has implemented a similar initiative in the marine sector through FuelEU Maritime. FuelEU Maritime targets will ensure that the greenhouse gas intensity of fuels used in the sector will gradually decrease over time, starting with a 2% decrease by 2025 and achieving an 80% reduction by 2050.

The Hydrogen and Alternative Fuels Programme will provide a stimulus for growth in the UK’s hydrogen sector, propel forward the alternative fuel market and begin the realisation of the substantial economic benefits the sector is forecast to bring.

Delivering the Technology Opportunity

The ability to make, move and store hydrogen in a cost-effective way will define the success or failure of the market. The critical challenge areas are detailed in Figure 12 below:

Technology innovation is needed in all areas to realise the hydrogen and alternative fuels opportunity. It is essential that we bridge that gap between critical first deployments ongoing now with the next generation of technologies. This will see the UK anchor its position as a global hydrogen powerhouse.

As the future energy system is built out, each emerging sector should not be considered in isolation and we must build for a digitally-enabled future. The interdependencies between renewables and hydrogen production, hydrogen for alternative fuels and carbon-capture-enabled steam methane reformation are a few examples of where close collaboration across sectors will be vital to unlock a sustainable energy future. This collaborative approach is embedded into NZTC’s way of working.

The Hydrogen and Alternative Fuels programme will leverage NZTC’s position in the energy and hydrogen sectors to make, move and store new fuels on an industrially relevant and internationally attractive scale. The NZTC has used this unique market insight and engagement with industry experts to outline the most impactful technology and innovation opportunities within this space, as outlined in Figure 13.

These range from GW scale technology development for export to a global market to undertaking infrastructure and refinery pivots for alternative fuel production and taking a UK wide approach to deliver national energy storage solutions and will apply to all four of the NZTC programmes.

Collaboration between the public and private sector will be essential to deliver this opportunity and as the programme is built out into delivery these opportunities will be tailored to meet our key stakeholder and industry challenges.

Let us know what you think of the opportunities we have identified.

Scan the QR code to provide your comments or suggestions or email us at [email protected]

Example Project

An example project for development as part of the hydrogen and alternative fuels programme is the delivery of GW scale technology development specifically for metering and compression. The hydrogen economy is a GW scale opportunity but the technology does not exist to safely transport hydrogen at this scale.

This programme provides a route to commercial deployment for metering and compression technologies and is borne out of the critical need identified through the ongoing Hydrogen Backbone Link project at NZTC.

Industrial Decarbonisation and Oil & Gas

Strategic Imperative

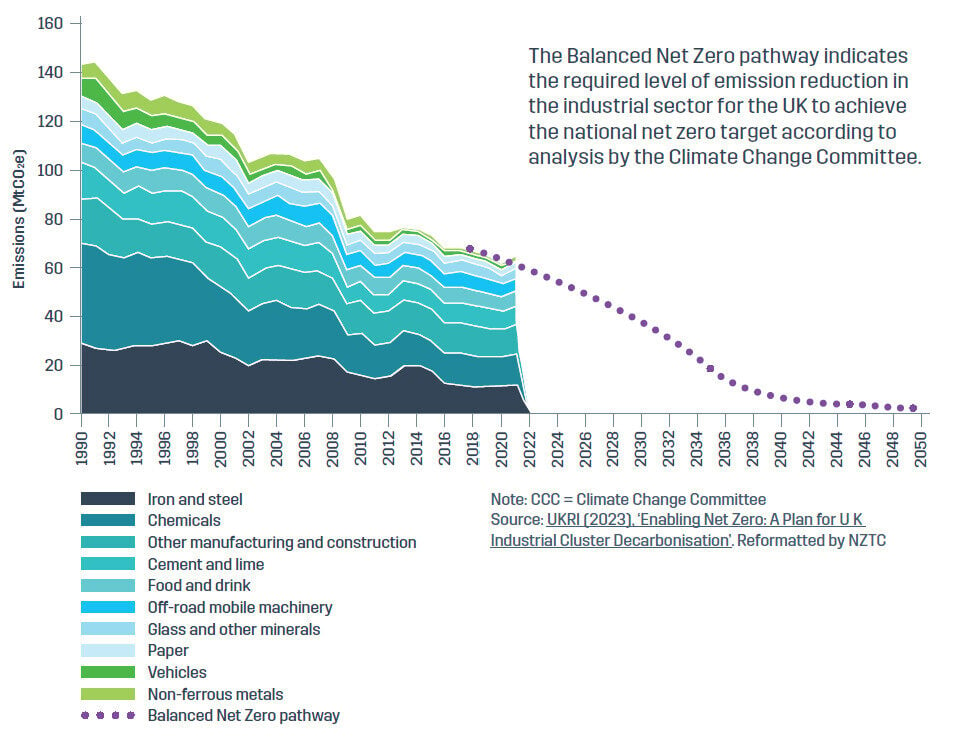

The UK has a world-leading track record of decarbonisation. Underpinned by the Climate Change Act, the UK was the first major economy to halve its emissions, cutting them by 50% between 1990 and 2022 while also growing the economy by 79%. The UK has further committed to reduce emissions by 68% compared to 1990 levels by 2030 as its Nationally Determined Contribution (NDC) to the Paris Agreement.

Despite this the Department of Energy Security and Net Zero estimates that net territorial greenhouse gas emissions for the UK were 384.2 MtCO2e in 2023. It is clear that further intervention is needed. With the Climate Change Committee estimating that only a third of this reduction is covered by actionable plans, intervention is needed across all sectors to bring the country back on track.

Figure 14 below outlines the sectoral contributions towards the UK’s GHG emissions reductions from industry, manufacturing and construction. These sectors are typically those which will be hard to abate through electrification or even fuel switching. An approach that considers first how to manage the emissions from the sector and then how to prevent and finally displace them is needed to provide a practical and achievable route to net zero.

The figure also highlights the decline pathway needed between now and 2050 to reach net zero in line with the Climate Change Committee’s Balanced Net Zero Pathway scenario. The decline pathway is steep. If we don’t act now we will be out of time.

Source: UKRI (2023), ‘Enabling Net Zero: A Plan for U K Industrial Cluster Decarbonisation’. Reformatted by NZTC

Source: NSTA Emissions Monitoring Report 2024. Reformatted by NZTC

In addition to the sectors illustrated in Figure 14 other UK industrial sectors including, but not limited to, refining, water and waste are also involved in the emissions reduction journey.

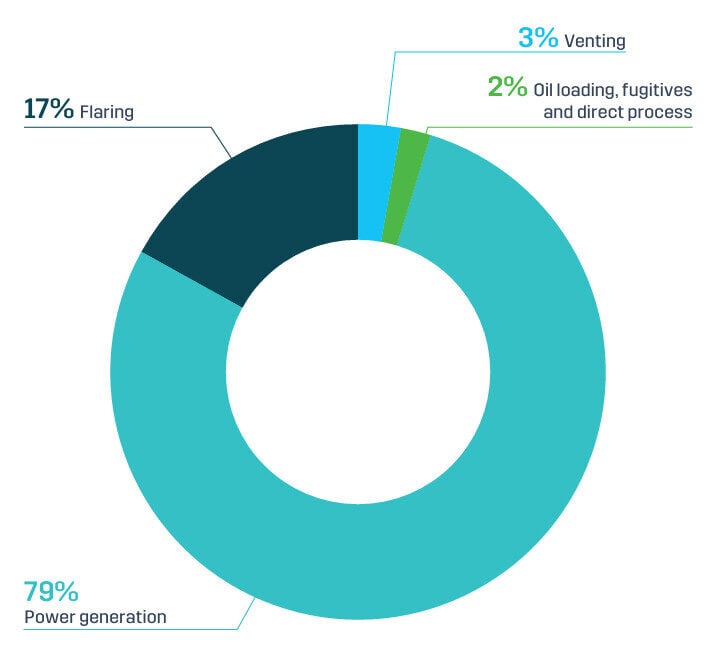

Upstream oil and gas accounts for 13.5mtCO2e, about 3.5% of total UK territorial emissions. Even in a declining production basin like the UKCS efforts need to be made – and are being made – to reduce carbon intensity of the residual hydrocarbon domestically produced and to meet the UK government targets, including a 50% reduction by 2030 and 90% by 2040.

While all GHGs are important, methane has a global warming potential about 80 times greater than CO2 during the 20 years after it is released into the atmosphere. Methane is therefore increasingly a global priority with governments and the private sectors accelerating action to address the challenge.

Action is needed across all sectors of the economy to deliver global ambitious goals with low-carbon technologies becoming the norm. The reducing cost of key industrial decarbonisation technologies presents a commercial opportunity for the UK to increase investment, reclaim its position as a global leader in climate initiatives and enhance energy security by accelerating the adoption of these technologies.

The Economic and Commercial Opportunity

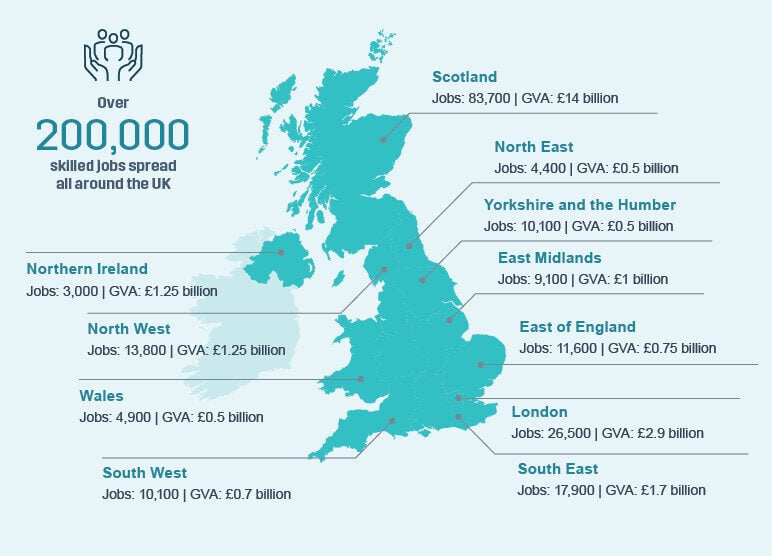

The energy sector in the UK plays a pivotal role in ensuring the economic and environmental growth of the nation. It has provided individuals and businesses with opportunities and jobs for decades. The offshore energy industry alone provides over 200,000 skilled jobs nationwide and contributed more than £25 billion GVA in 2022 / 2023. The locations of the jobs and GVA contribution are shown in Figure 16.

Source: Source: OEUK (2024), ‘Economy & People Report 2024’, 2023 estimates. Reformatted by NZTC

As the UK decarbonises, the offshore energy sector is set to grow, benefiting from a wealth of energy potential to deliver a homegrown energy transition. OEUK estimates that between now and 2040, £450 billion will be spent in capital projects offshore covering all energy vectors, spurring economic growth and fostering UK technology and innovation across the energy mix.

Decarbonisation is a global challenge and it will take a global effort to achieve it. Technology development and joint industry projects delivered to monitor, measure and abate emissions will be essential to meet net zero targets. NZTC’s industrial decarbonisation programme will support the rapid response required in this sector.

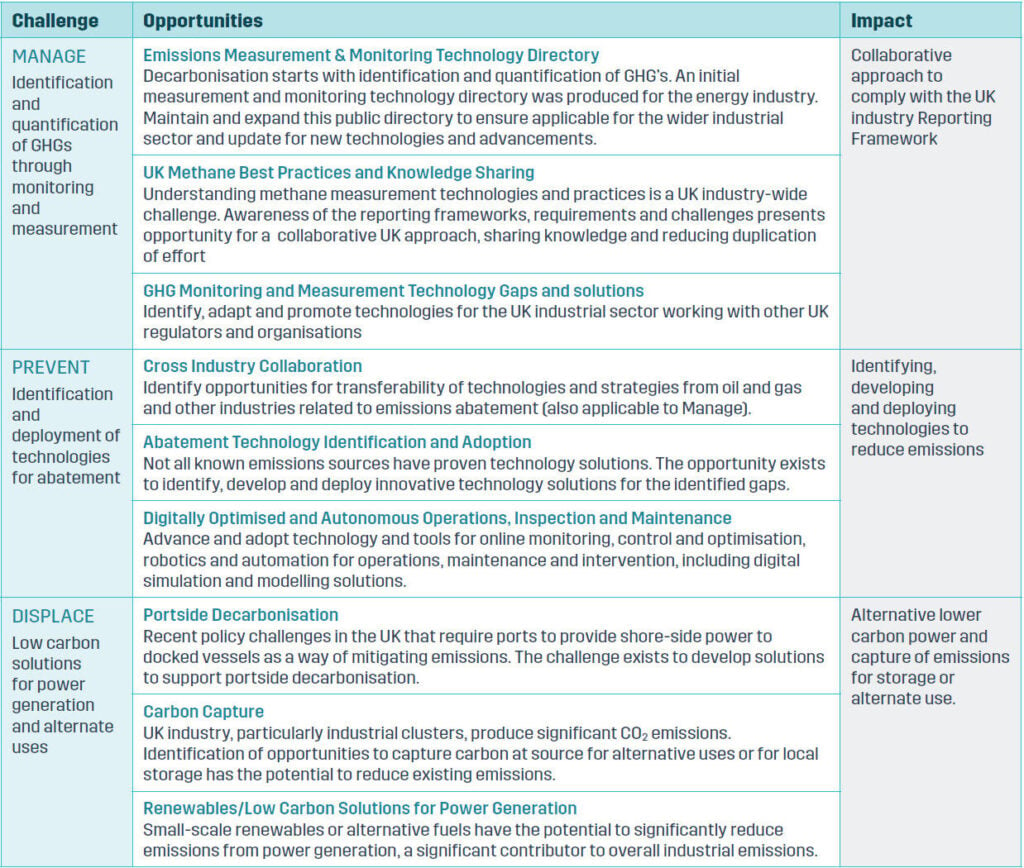

Delivering the Technology Opportunity

For industrial decarbonisation to advance at pace industry needs to be able to manage, prevent and ultimately look to displace key sources of emissions. We need to tackle these areas as a matter of priority as outlined in Figure 17 below:

There needs to be a common programme to drive forward decarbonisation across all industry sectors as the challenges and opportunities are shared. The increasing global focus on GHGs and methane in particular means that much of the programme will be applicable across wider industries both at home and overseas.

Decarbonisation starts with identification and quantification of the GHGs through monitoring and measurement. Understanding and improving the data on the emissions sources enables targeted and measurable abatements to be applied to prevent unplanned or fugitive releases.

While managing and preventing are necessary in the short term, switching to low carbon solutions, such as alternative fuels or renewables for power generation or capturing emissions, will produce the greatest GHG emissions reductions for the majority of industries whether part of an industrial cluster or remotely located or isolated. Given the strength and depth of the existing energy supply chain in the UK, the emphasis must be on the transfer of technology with high impact opportunities outlined in the roadmap below.

NZTC is already closely working with industry and the regulators to provide an integrated way of addressing this complex issue. Our demonstrable impact in the energy sector means that the NZTC has the insights and skills to continue to deliver impactful projects in this space.

Let us know what you think of the opportunities we have identified.

Scan the QR code to provide your comments or suggestions or email us at [email protected]

Example Project

Through portside decarbonisation there is an opportunity to provide alternative fuels to support energy intensive activities in ports and for port users. With e-methanol in particular gaining interest as an alternative fuel for maritime application, there is a need to understand how facilities to store and use e-methanol could work in practice.

This programme would provide a route to commercial deployment for peak power demand solutions particularly for those ports or port users who don’t have a direct connection to the grid and an imperative to decarbonise

Shetland, UK

Industrial Collaboration

Wells P&A

The Wells Decommissioning Collaboration is a multi-operator consortium accelerating the rate at which technology is developed, tested and piloted for well decommissioning.

Overview: NZTC is raising £2.4m per year in a collaboration originally envisaged to run from 2022 – 2026 to explore and develop new technology that would significantly reduce the cost associated with well P&A both onshore and offshore. Technology developed in the North Sea by British and European developers has

global applications in markets as varied as the USA and Australia. The collaboration is supported by seven global operators including Petrobras, ConocoPhillips, Harbour Energy, Repsol, TotalEnergies, Equinor and OKEA.

Outcomes: As a consequence of this collaboration, £6.89m has been invested by industry, academia and government into the P&A technology space to reduce both operator and public liability for decommissioning. The collaboration has been so successful that it is likely to be extended and grow to ten supporting operators in the next 12 months. It will abate an estimated 5.8MtCO2e by 2030 through 15 live projects, operating in eight countries on four continents.

Joint Industry Project (JIP)

Methane

The Methane Measurement Joint Industry Project (JIP) aims to better educate the industry around the key issues associated with aerial methane measurement offshore.

Overview: The JIP is seeking to address the recommendations made from the OEUK aerial methane

measurement technical note which demonstrated that improved understanding was required of the repeatability of top-down measurements. The uncertainty provided by top-down vendors is largely a consequence of a ‘one-size-fits-all’ value based upon instrumentation and controlled releases. There is limited transparency of how the values are derived, and the impact of environmental conditions and emission rates is rarely provided. The JIP also seeks to Inform those writing the standards for top-down methods and provide basic requirements for the selection of a method and quality control of the data capture.

Outcomes: The JIP is underway at time of writing and has received significant interest from more than five

industry partners predominantly based here in the UKCS.

Carbon Capture and Storage (CCS)

Strategic Imperative

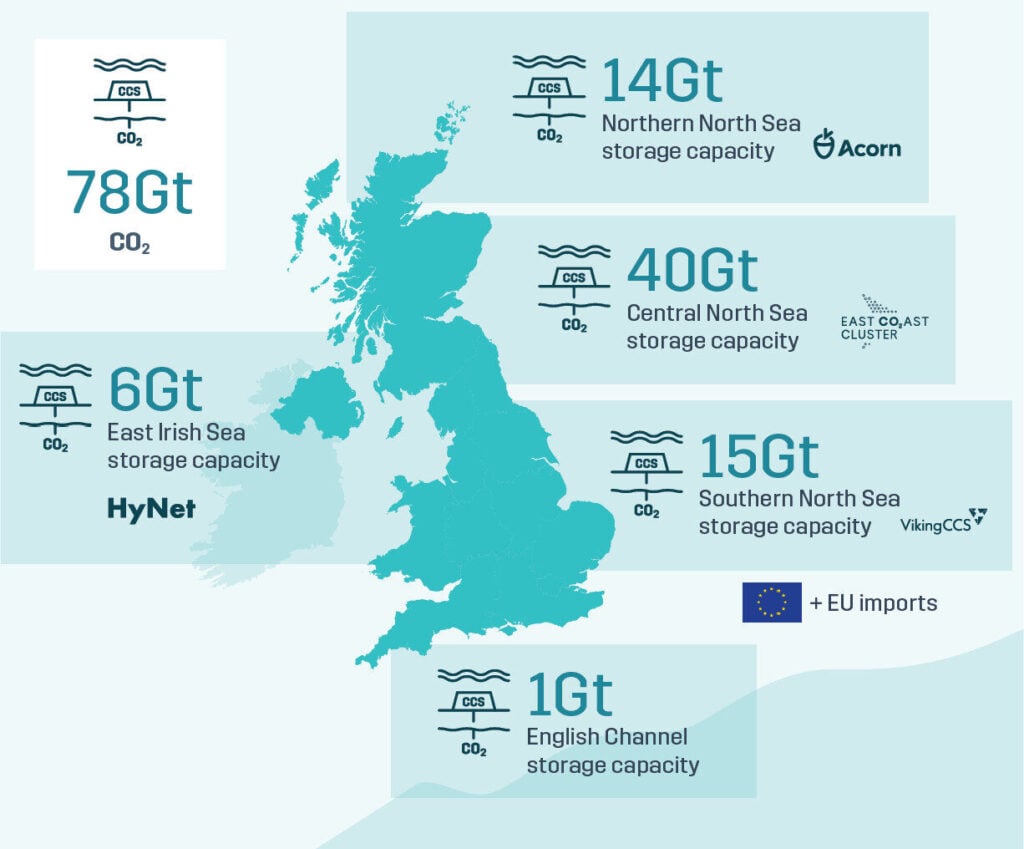

The Climate Change Committee’s 7th Carbon Budget states it “cannot see a route to net zero that does not include CCS.” It is a necessity if the UK is to meet its target to deliver 30 Mt per annum of CO2 storage by 2030 (equivalent to 12 million cars off the road) and net zero by 2050. With Europe’s largest offshore storage potential, the UK is also positioned as an international hub for CO2 storage needs.

CCS is the only way to protect key UK industries, helping to retain jobs in regions that rely on these industries. Industries such as steel, cement, refining chemicals, glass and ceramics all emit CO2 as part of a chemical process required in production.

As well as removing industrial and power emissions, CCS has the potential to produce net-negative emissions through engineered carbon removal process such as bio-energy carbon capture and storage (BECCS) and direct air carbon capture and storage (DACCS). With the ambition to capture 5 MtCO₂ per annum of engineered removals and ramping up to 23 MtCO2 per annum by 2035 it is imperative that existing technologies are proven in the field and new technologies are de-risked and demonstrated.

The UK is well-prepared to scale CCS with the government committed to establishing four CCS clusters by 2030 through their Cluster Sequencing process.

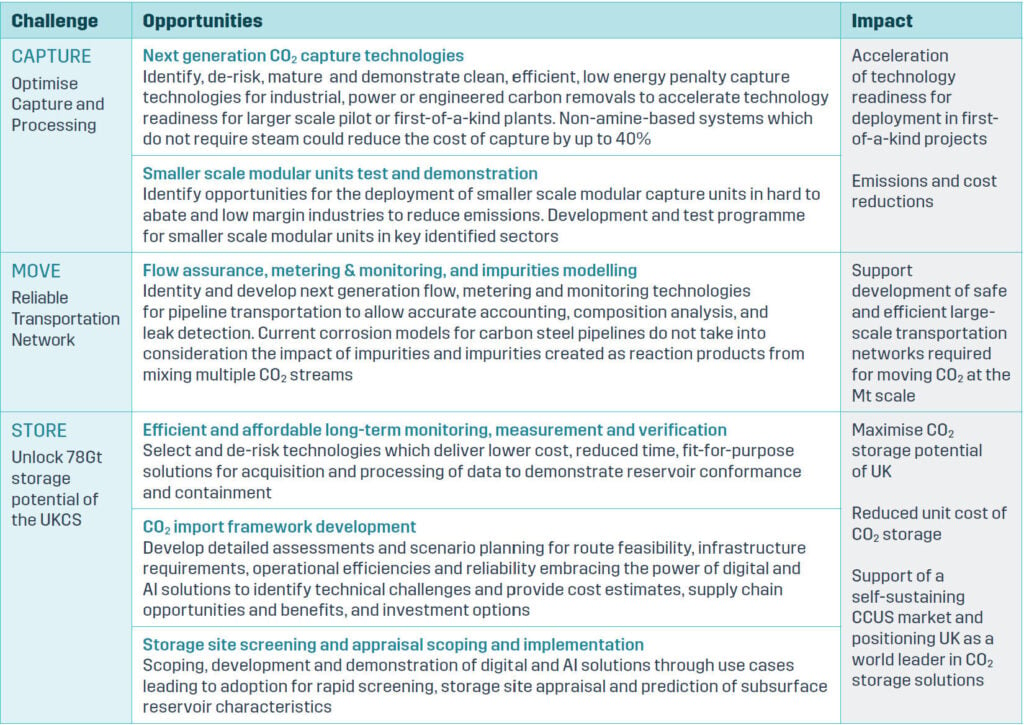

It is critical to invest in the development and demonstration of emerging CCS technologies now, to help reduce costs and plug the technology gaps in support of the deployment of affordable carbon capture and the operation of safe and efficient transport and storage networks at scale.

Source: OEUK (2024), ‘Carbon Capture Utilisation and Storage (CCUS) Insight’. Reformatted by NZTC

The Economic and Commercial Opportunity

CCS technologies are vital for the UK to meet net zero by 2050. It is the only viable solution to remove existing CO2 from the atmosphere at scale. With the first carbon storage licensing round awarding 21 licence offers, the UK’s CCS sector could generate up to 50,000 new jobs by 2030. CCS projects could also help protect more than 100,000 jobs across other sectors that would be unable to achieve net zero by 2050 without emissions abatement.

Cross-border transportation of CO2 could also bring considerable economic and supply chain benefits. A supply chain study commissioned by OEUK to Rystad Energy outlines the financial opportunities for the UK’s supply chain from the expansion of domestic CO2 storage to include emissions from Europe.

The analysis includes a scenario that shows that the upside potential for UK supply chain companies could be in the region of £7 billion over the course of the next 15 years if 30% of emissions from European emitters were stored in the UK reaching £1 billion per year by 2040. Delaying the process of unlocking cross-border transportation for the UK would greatly reduce our ability to compete internationally for European emissions.

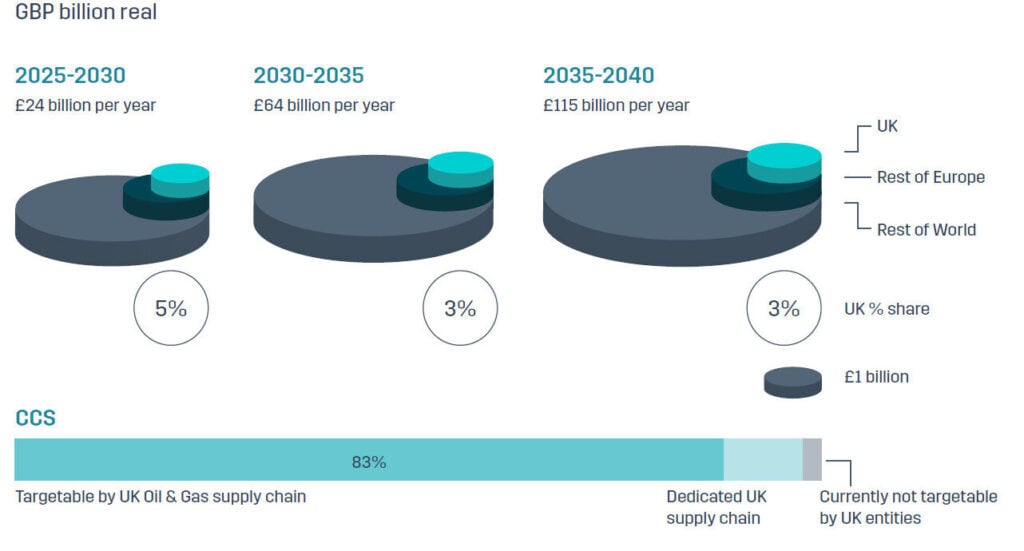

The same Rystad report forecasts that annual expenditure in the UK CCS market will average £3.4 billion per year in the period 2035-2045. 83% of this market is expected to be addressable by existing UK oil and gas supply chain firms. See Figure 20.

The UK’s extensive oil and gas heritage makes it a natural leader. Testing and demonstration of emerging technologies and the identification of new technologies will play a critical role in the scaling up of CCS helping to bring additional costs reductions. It is expected that this research and development is led by industry and this is where NZTC can play a vital role in helping to share the risk of innovation through targeted funding schemes to bring technology to market.

Source: OEUK (2024), ‘Carbon Capture Utilisation and Storage (CCUS) Insight’.

Delivering the Technology Opportunity

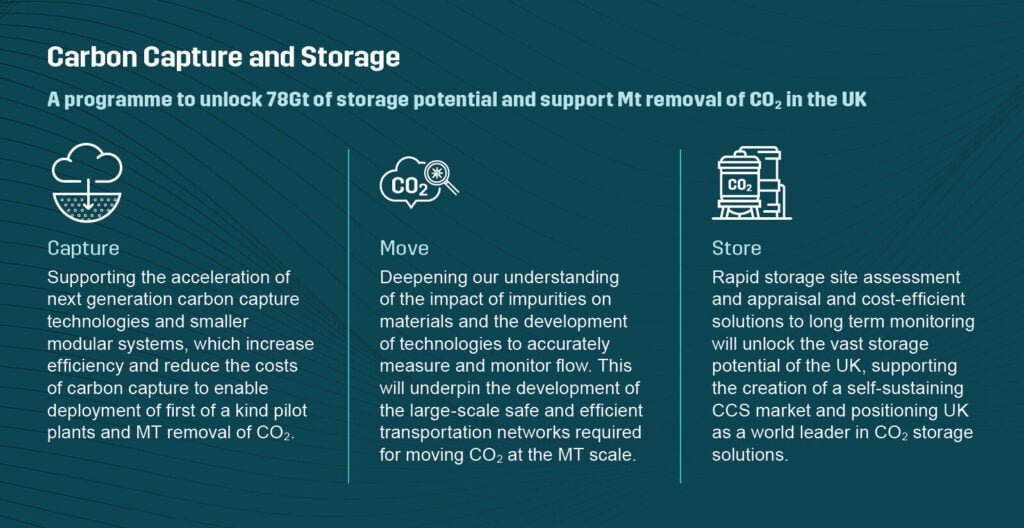

To deliver a world-leading CCS sector, the UK needs to be able to capture, move and store CO2 as cost effectively as possible. Addressing these areas will provide a platform to grow the UKs sector and create a self-propelling market. These three fundamental challenge and opportunity areas are described further in Figure 21 below:

Delivering on these opportunities will bridge the gap between critical first deployments with the next generation of technologies that will see the UK anchor its position as a global CCS leader and achieve its ambitions of capture and storage.

Major CO₂ transport and storage infrastructure is also required to enable the move CO₂ via pipeline and non-pipeline solutions. This will connect emitters within centralised clusters and isolated emitters to storage sites and facilitate the import of CO2 from other geographical regions.

The CCS industry must be built with embedded advanced digital solutions from the start. The use of digital models during the conceptual design of CCS projects will enable designers to optimise candidate designs and assess performance and reliability before pilot testing and construction. Real-time monitoring and autonomous operations have the potential to play a significant role in the transport and storage of CO2. Getting fast and accurate measurements on flow assurance, CO2 specification, moisture content and potential leaks will lead to more efficient and safer transportation networks.

The CCS programme of activity will leverage NZTC’s position within the energy and CCS sectors to identify and mature technologies to position the UK as a leader in innovation and deployment across the CCS value chain. The key opportunities within the sector are outlined below.

Let us know what you think of the opportunities we have identified.

Scan the QR code to provide your comments or suggestions or email us at [email protected]

Example Project

Carbon capture technologies are needed at all scales. An example project within the carbon capture and storage programme looks to address this opportunity by developing smaller scale and modular design capture units. This is particularly relevant and important in applications with space constraints or industries with low margins such as energy from waste plants or biomass power plants.

This programme would provide a route to commercial deployment for these technologies and is borne out of the critical need identified through the NZTCs ongoing work in capture projects such as Smart DAC and ACT3.

Joint Industry Projects:

Cold Duty SSSV Qualification

This JIP led by NZTC focused on the qualification of low temperature Subsurface Safety Value (SSV) with nine operating partners valued at £2M.

Overview: We developed a qualification protocol for SSSV for low temperature CO2 service. Valves currently on the market are not certified below -5°C with few scopes performed based upon testing individual SSSV components. The industry requires valve systems which are capable of functioning at -78 °C. Through this JIP we have influenced the industry standard – API 14A – to expand the standard for the consideration of low temperature qualification. Three companies, Baker Hughes, SLB (formerly Schlumberger) and Halliburton were selected to each test variant sizes of SSSV’s, 3-1/2”, 4-1/2” and 5-1/2”.

Outcomes: The JIP achieved market expansion of safety critical equipment availability under an approved and tested standard capable of operating in the conditions applicable to the storage of CO2 in reservoirs.

Digital for net zero

Strategic Imperative

The exponential growth of digital technology is rapidly transforming how we communicate, work and conduct business. Digital technology will continue to impact the energy industry at pace, altering business models and becoming a major disruptive force. To that effect, the energy industry’s transition is both data-driven and increasingly digital-first. Embracing digitalisation is no longer a choice, it is a necessity.

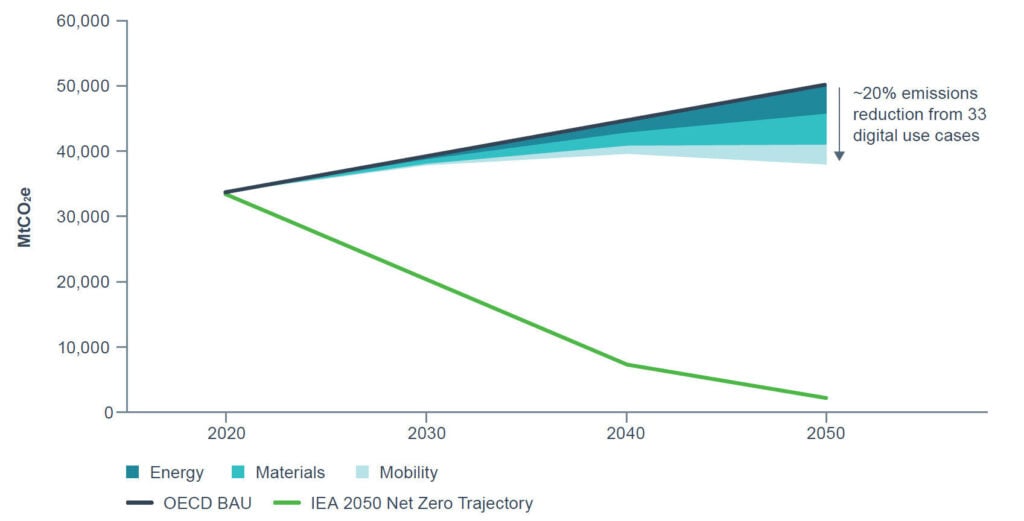

A study by the World Economic Forum found that digital solutions could reduce 2020 global emissions by up to 20% by 2050 and can already reduce emissions by 4-10% by 2030 by accelerating the adoption of digital technologies. The report emphasised that to do this there must be improved digital skills, data transparency and accelerated technology adoption. Within the UK the emphasis on digital adoption is also echoed by the UK Government Artificial Intelligence Action Plan which will consider how the UK can adopt artificial intelligence to enhance growth and productivity.

Countries and organisations that leverage digital technology are more likely to succeed in their decarbonisation plans, reduce emissions and achieve their goals more rapidly than those that do not. Since data fuels modern businesses, there is a significant opportunity for the UK to leverage its data more strategically, fostering both innovation and economic growth.

The digital technology space has been accelerating innovation but rather less successful has been adoption and deployment rates. Successive UK governments have committed to support increasing adoption through the formation and continuation of a Digital Adoption Taskforce. Although the adoption challenge applies across many industries, the energy industry faces particular challenges which is where NZTC can help.

The Economic and Commercial Opportunity

The energy industry is experiencing a significant transition towards decentralisation, decarbonisation and digitalisation. This transition is providing new opportunities and challenges for investment and growth both domestically and internationally and digital is already playing a leading role.

The sluggish adoption rates in the UK are expected to have a significant impact on the economy but there is a window of opportunity as the energy network becomes more complex to overcome these challenges.

In July 2021 the Government published its first energy sector digitalisation strategy and action plan which outlined ways to digitalise the energy sector through providing leadership collaborating with the sector to develop digital tools and ensuring regulation and policies incentivise digitalisation. Digitalisation will help to drive the energy transition in many ways with key opportunities in operational efficiency, design and redesign and new business models.

There is direct evidence of the benefits of digitalisation including improving efficiency and reducing costs. McKinsey & Company have reported that in cases where energy companies have implemented digital technologies effectively, there have been improvements in production and efficiency ranging from 2 to 10%, and cost reductions between 10 and 30%. If these benefits are maintained at a larger scale, they could significantly impact competitiveness, enhancing cost efficiency by £7 to £30 per megawatt-hour in power generation.

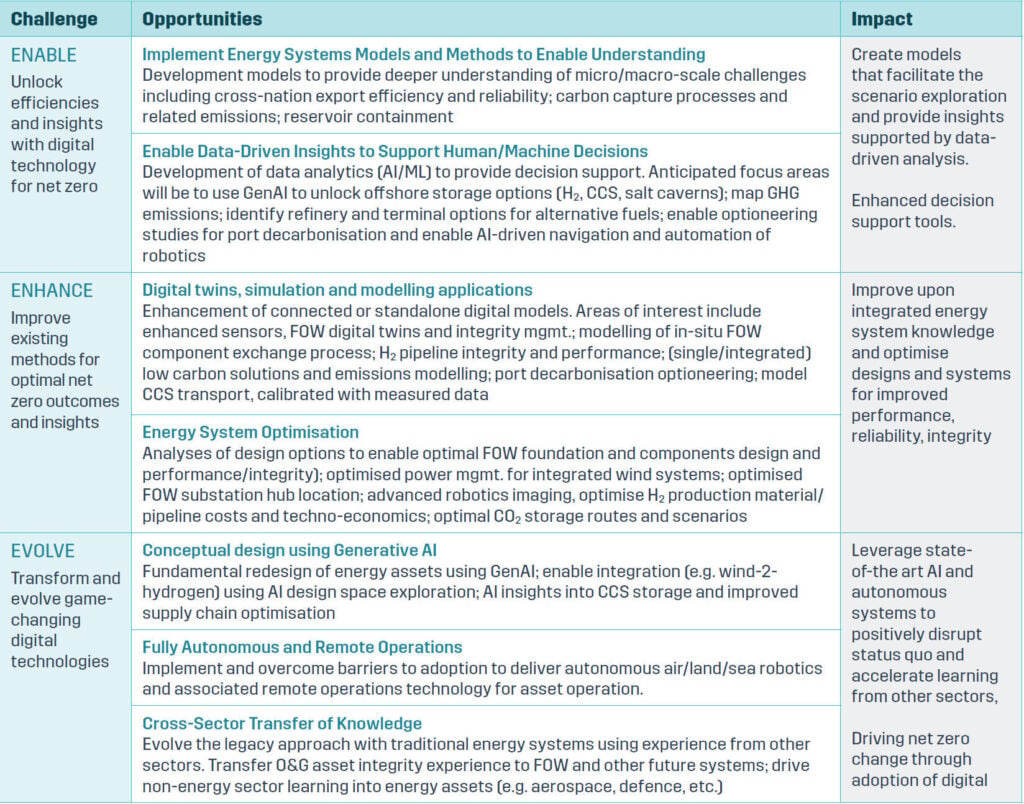

Delivering the Technology Opportunity

There is an urgent need to provide a connected pathway to widespread adoption of digital technologies that reduce emissions and accelerate the energy transition. This would provide a clear route to adoption by technologies that enable new methods and models, those that enhance existing systems and those that fundamentally evolve what we have now:

As we transition towards a more sustainable and efficient energy landscape, the adoption of digital solutions will be a crucial tool to optimise operations, enhance energy efficiency and reduce carbon emissions. Digital technologies such as Internet of Things (IoT), AI and advanced analytics enable real-time monitoring and predictive maintenance which can significantly reduce downtime and operational costs and facilitate better decision-making.

Digital tools such as digital twins and simulation software allow for the creation of detailed virtual models of energy assets. Digital or virtual testing can significantly accelerate time to market and improve product quality, reducing engineering hours by up to 20%, rework by as much as 50% and cost reductions ranging from 5% to 30%. Digital solutions enable the smart management of energy flows balancing supply and demand and enhancing grid stability.

To ensure the UK doesn’t fall behind in the race to net zero, it must deliver on the digital opportunities that exist across the emerging energy transition vectors. Those which NZTC have identified as having the greatest potential impact are outlined below:

Let us know what you think of the opportunities we have identified.

Scan the QR code to provide your comments or suggestions or email us at [email protected]

Example Project

New energy solutions are needed that, whilst integrating with the existing network, will challenge the historical rules and best practice and will push the boundaries in terms of efficiency and material selection (sustainability) and will drive improved energy efficiency for design and off-design operating conditions. In addition, the new energy assets must be designed to accommodate digital technology from the outset (sensors, communication networks, digital twins, remote operations, autonomous systems and robotics etc.).

An example project within the Digital for Net Zero programme would look to build and develop computational models (digital twins) that enable design studies to be explored, options to be considered and decisions to be taken during the conceptual and pre-construction phases of the H2/CCUS/FOW asset lifecycle. Considerably easier and cheaper to do at this stage, digital models will enable modular construction, improved material selection and improved design decisions for these future systems. Such modelling approaches would enable better understanding of the impact of new assets when connected to the wider, complex energy network.

Continue reading

Discover more by downloading the full report via the button below.