NEWS & INSIGHTS | Opinion

Global investment in clean energy and reducing hydrogen costs in the UK

Energy Transition Investment; World’s Largest Energy Hub; H2 Cost Reductions

Chief technology officer Luca Corradi and his team monitor the global net zero landscape closely. They follow trends, policies, investments and technology innovations that get the world closer to its shared climate goals. Learn more about our horizon scanning service. This week, Luca and his team share Bloomberg NEF’s recent report on global energy transition investment trends, explore the potential of the world’s largest proposed energy hub, and explore recommendations on ways to reduce the cost of electrolytic hydrogen in the UK.

Energy Transition Investment Trends 2025

Global energy transition investment surpassed $2 trillion for the first time, more than doubling since 2020. However, the growth rate of energy transition investment slowed to 10.7% in 2024, down from 24-29% annually during 2021-2023. The largest sectors were electrified transport at $757 billion, renewable energy at $728 billion and power grids at $390 billion. All three sectors reached new records, as did energy storage, which hit $54 billion.

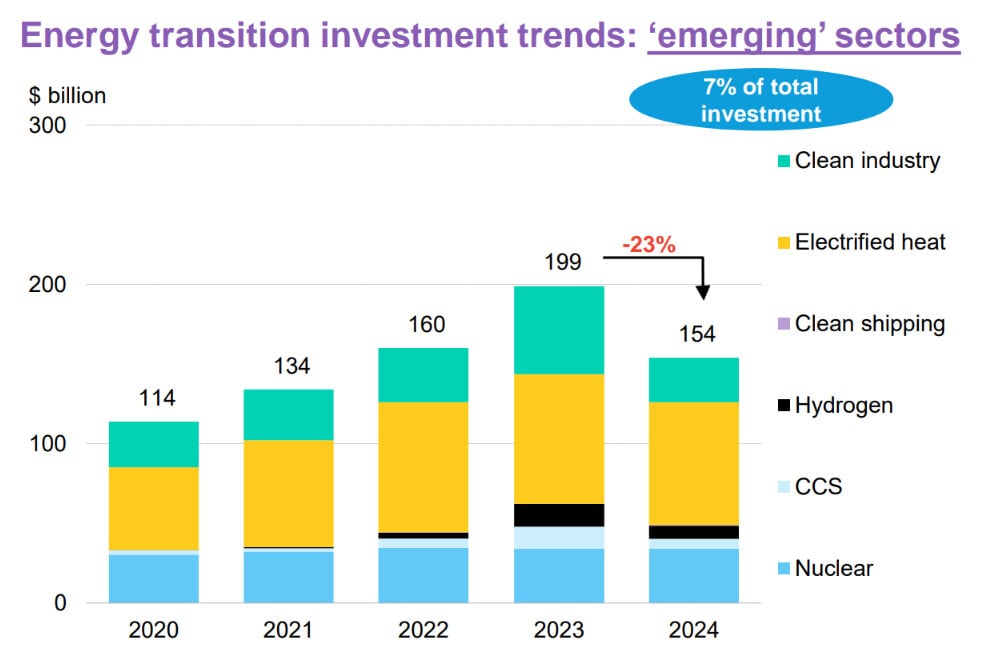

Annual investment is running at just 37% of the level required until 2030 to achieve net zero by 2050. The other seven sectors—nuclear, carbon capture and storage (CCS), hydrogen, clean shipping, electrified heat and clean industry— accounted for only 7.4% of investments, and actually declined 23%. Investment in CCS and clean industry halved to $6.1 billion and $27.8 billion, respectively. Hydrogen investment dropped by 42% to $8.4 billion. Government policy makers and the private sector must work together to de-risk these technologies for scale up.

Source: Bloomberg NEF Energy Investment Trends 2025

UK, EU, and US drove most of the growth in 2023. In 2024, investment remained flat in the US at $338 billion, while the EU-27 ($381 billion) and the UK ($65.3 billion) saw declines. Meanwhile, mainland China outpaced these three markets combined, investing more than them and accounting for 81% of global investment in clean energy supply chains. Progress is happening on onshoring supply chains outside of mainland China. But in the US, Europe, and India, manufacturing inexperience, high local costs, and political risk threaten supply chain investments. Climate-tech companies raised $50.7bn in private and public equity in 2024, down 40% year-on-year, marking the third consecutive year of contraction – despite overall venture funding in the economy increasing.

BloombergNEF’s annual review of global investment in the low-carbon energy transition.

World’s Largest Energy Hub

The Western Green Energy Hub (WGEH) is a proposed energy hub in Western Australia, if developed, would be the largest renewable energy hub in the world. With a planned area larger than the entire country of El Salvador, the complete project would have a capacity of 70 GW.

The WGEH aims to produce more than 200 TWh of renewable energy annually, nearly matching Australia’s total power output of 274 TWh in 2023. The hub will consist of nearly 3,000 next-generation wind turbines, each rated between 7 MW to 20 MW, along with 60 million solar panels across 35 solar farms.

The project will produce power for various applications, including the potential production of approximately 3.5 million tonnes of green hydrogen per year, as well as derivatives like ammonia for power generation, marine fuel, minerals processing, and heavy transport. WGEH is targeting local, national and international export markets for its products. The final investment decision (FID) for the first stage is due in 2029. The development will also include worker accommodations, fabrication facilities, and an infrastructure corridor from the hub to the coast. The construction, which is planned to take approximately 30 years, will be split into seven stages. The project is a partnership between InterContinental Energy and CWP Global, who previously worked on a 26 GW mega project in Australia, currently owned by BP, and a 25 GW energy plant in Oman.

Australia’s proposed Western Green Energy Hub has begun its first round of public consultation.

Image source wgeh.com.au

Splitting the Difference – Reducing the Cost of Electrolytic Hydrogen to Accelerate Deployment

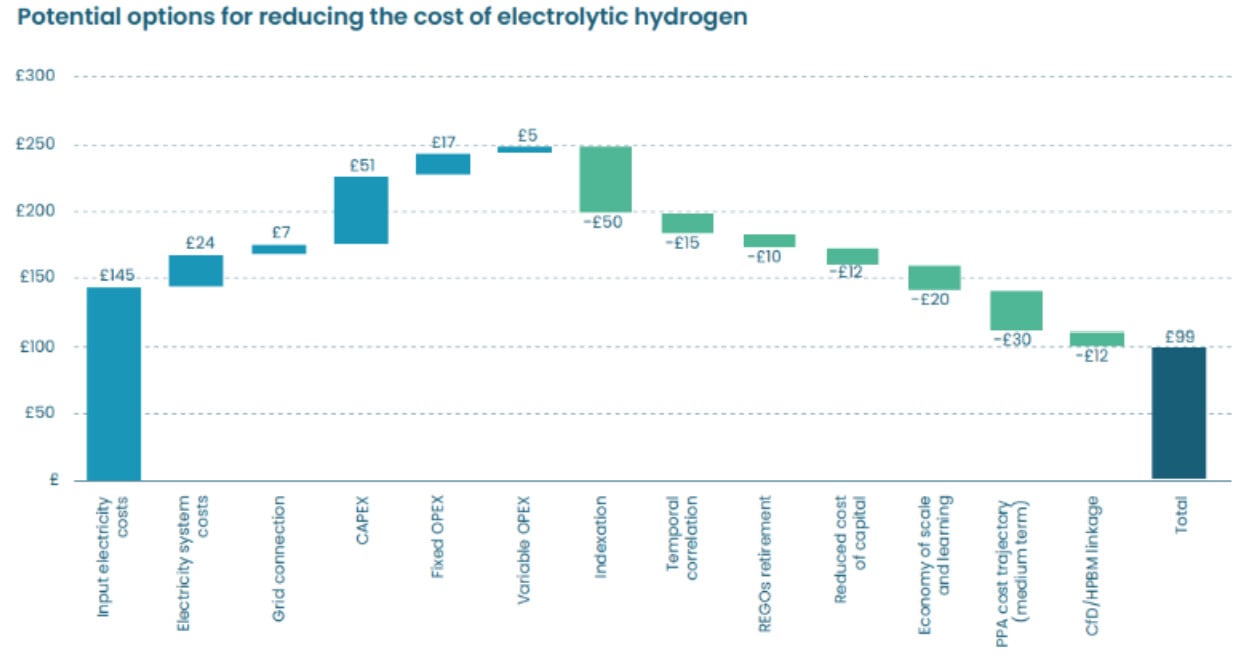

The first Hydrogen Allocation Round (HAR1) achieved an average price of £241/MWh. Implementing the recommendations from the ‘Splitting the difference’ report could reduce this cost to less than £100/MWh, making hydrogen competitive with natural gas and potentially creating 30,000 jobs and £7 billion GVA by 2030.

Potential options for reducing the cost of electrolytic hydrogen

Source: ‘Splitting the difference’ report by Hydrogen UK and Renewable UK

Recommendations include:

- A call for the Government to reform the hydrogen production business model (HPBM) with realistic strike prices to secure the maximum amount of investment by companies entering this new market

- Incentivising electrolysis to happen at the time and place when electricity is cheapest, to bring wider benefits to our energy system and avoid wasting electricity due to grid limits (4 TWh of renewables was curtailed in 2023)

- Removing barriers to enable hydrogen producers to co-locate their projects with renewable energy generators which already have planning consent.

- An ambitious strategy to enable the development of a hydrogen transmission network, with pipelines linking Scotland to England and Wales to optimise the availability of green hydrogen

Reducing the charges which project developers must pay for access to the electricity grid could significantly lower costs. A fixed price of PPA (power purchase agreement) could add more than £50/ MWh to the Levelised Cost of hydrogen.

Our horizon scanning service helps you keep up to date with net zero technology advancements, investments and policies. Learn more about horizon scanning.

Subscribe for the latest updates