NEWS & INSIGHTS | Opinion

Why Scotland needs more than wind to deliver hydrogen at scale

This week’s net zero news: Net Zero Technology Outlook; Hydrogen Supply Chain; Northern Lights CCS

Chief Technology Officer at NZTC, Luca Corradi, and his team closely monitor the global net zero landscape. They follow the trends, policies, investments, and technological innovations that, together, bring the world closer to its shared climate goals. Learn more about our horizon scanning service. This week, Luca and his team look at key tech, research and development needed to achieve net zero for five major sectors, supply chain needs for hydrogen production projects in Scotland, and next-generation nuclear energy, and CO2 storage milestone in Norway.

Key technologies identified in the Net Zero Outlook

The Net Zero Technology Outlook identifies the key technologies and research, development and demonstration (RD&D) needed to achieve net zero for five major emitting sectors: industry, power, transport, heat and buildings, agriculture, land use and waste. It also outlines RD&D challenges in three cross-cutting areas: hydrogen, biomass, and greenhouse gas removals (GGR) and Carbon Capture, Utilisation and Storage (CCUS).

The RD&D priorities include:

Power

Floating offshore wind: Innovations in designs, mooring lines and dynamic cables

Advanced nuclear reactors: Focus on underpinning design, new fuels and increased flexibility

Grid digitalisation: Use of AI and the Internet of Things (IoT) to increase optimisation and flexibility

Battery sustainability: Advancements in cell chemistry, manufacturing techniques and recycling technologies

GGRs and CCUS

Direct Air Carbon Capture and Storage: Development of novel technologies to improve capture performance, modular point-source CCS systems, reduced energy demand for CO₂ separation and regeneration, and integration of large-scale renewable heat sources.

Novel GGR solutions: Continued development, testing, and demonstration of innovative GGR technologies through field trials and pilot projects.

Hydrogen

Production: Exploration of emerging small-scale technologies for green and blue hydrogen (including biogenic, solid oxide, nuclear, and alternative reforming methods), as well as research into naturally occurring (white) hydrogen.

Storage: Demonstration of alternative, cost-effective, large-scale hydrogen storage options that are faster and more widely deployable than traditional salt caverns – such as lined rock caverns.

Supply chain requirements for hydrogen production projects in Scotland

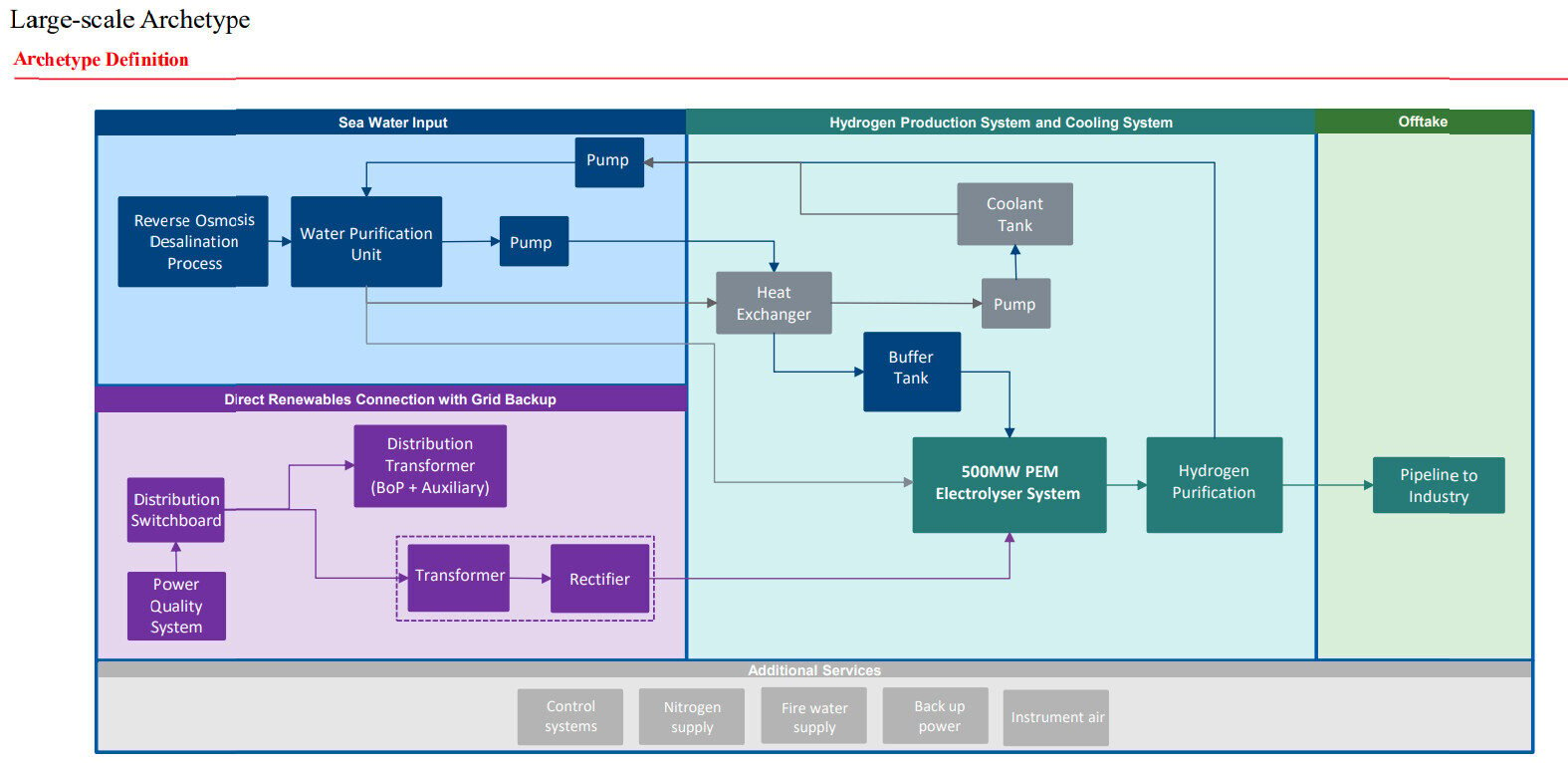

A study by Arup, commissioned by Scottish Enterprise, offers a comprehensive overview of the supply chain needs for two hydrogen production projects: one small-scale and one large-scale.

The report outlines the end-to-end supply chain requirements for hydrogen production at two scales:

- Large-scale: 400–600 MW

- Small-scale: 10–20 MW

The key differences between the archetypes are:

- Time and resources required for project development and execution

- Materials and components needed for manufacturing key equipment

- Sources of raw material inputs (water and electricity) and outputs (end uses)

The large-scale archetype introduces additional supply chain complexities. These may pose challenges for Scotland, including:

- Availability of water, electricity, materials and skilled resources

- Proximity to regional or national hydrogen pipelines

- Need for large-scale storage infrastructure

Image source: Hydrogen Economy Research: End-to-End Supply Chain Map, 2025

A direct connection to a large-scale generation asset – such as an offshore wind farm or a transmission-scale grid – is likely required for large-scale hydrogen production.

Arup have identified key opportunities in areas such engineering and professional services, wind resource, specialist components manufacturing, hydrogen logistics and hydrogen export/derivatives. Export of hydrogen to other countries with significant demand, such as Germany, presents a unique opportunity for Scotland to be a global leader in the hydrogen industry.

However, the report highlights key critical bottlenecks. This includes large-scale manufacturing capacity for equipment such as electrolysers, compressors, storage vessels and tube trailers, and a reliance on the raw materials required for manufacturing of plant equipment (e.g. steel) from other countries.

Norther Lights CCS achieves first CO2 storage milestone

The Northern Lights carbon capture and storage (CCS) project has successfully stored its first volumes of CO₂ .

The first phase is part of Longship, the Norwegian Government’s full-scale CCS initiative, and represents the world’s first cross-border CO₂ transport and storage project open to industry. The Northern Lights joint venture is owned by Equinor, TotalEnergies and Shell.

Liquefied CO₂ from capture sites is shipped to their onshore receiving terminal in western Norway. From there it’s transported 100km by pipeline and injected into the Aurora reservoir, located 2,600m below the seabed, for permanent storage.

In March 2025, Northern Lights made the final investment decision to increase its capacity. The project will scale from 1.5 million tonnes of CO2 per year to a minimum of 5 million tonnes per year. The expansion leverages existing infrastructure and includes additional onshore storage tanks, pumps, a new jetty, injection wells, and more CO₂ transport ships to enable an increased injection rate and volume

Northern Lights will transport and store CO₂ from Norway for the remainder of 2025, with CO₂ volumes from Denmark and the Netherlands expected to be added in 2026.

Image source: norlights.com

Subscribe for the latest updates