NEWS & INSIGHTS | Opinion

CCS Milestone: Liverpool Bay Project Set to Break Ground in 2025

This week’s net zero news: Roles for Hydrogen; £300mn for Offshore Wind; Liverpool Bay CCS

Chief Technology Officer at NZTC, Luca Corradi, and his team closely monitor the global net zero landscape. They follow the trends, policies, investments, and technological innovations that, together, bring the world closer to its shared climate goals. Learn more about our horizon scanning service. This week, Luca and his team look at insights into the future uses of hydrogen, new funding for offshore wind related project and explore UK’s newest CCS milestone.

Researchers from Imperial College London provide an insight into feasible futures for hydrogen

Hydrogen’s current global demand, encompassing both grey and low-carbon types, is just under 100 Mt—a fivefold increase since 1975. Despite this growth, hydrogen accounts for only 3% of global final energy consumption. Currently, almost all hydrogen today is grey, and scaling up clean production is extremely challenging. Producing 100 Mt of green hydrogen annually would require 1.25 times the entire global fleet of wind and solar power.

Today, hydrogen is primarily used in industry, with 50% used for ammonia and methanol production and 45% for petroleum refining. However, to avoid past pitfalls, supporting hydrogen in areas with clear competitive advantages could help. Specifically, this includes backing hydrogen where cheaper and more convenient alternatives already exist, and underinvesting in its most competitive—and unavoidable—use cases.

We should prioritise support for clean hydrogen in unavoidable applications like petroleum refining and fertilizer production. As well as other competitive uses including steelmaking, long-haul heavy transport and long-duration energy storage. On the other hand, bulk e-fuels, bulk power generation and passenger cars are considered less competitive for hydrogen use. Current production cost estimates for hydrogen vary widely, making 2030 targets challenging to meet. In 2023, the cost of green hydrogen ranged from $3.90 – $9.20/kg, while blue hydrogen was 35-50% cheaper at $1.90 – $5.90/kg. Grey hydrogen was even cheaper at $1.00 – $4.30/kg. Transport and storage also pose major cost barriers. Transporting hydrogen more than 250 km reportedly doubles end-user costs, and shipping liquid hydrogen costs 4-6 times more than Liquified Natural Gas (LNG).

Figure: Applications for hydrogen, qualitatively ranked in terms of competitiveness against alternatives.

The Prime Minister has brought forward £300 million for Great British Energy to invest in offshore wind supply chains

The UK Government has announced that £300 million has been earmarked for offshore wind related projects over the course of the Parliament. This funding will enable Great British Energy (GBE) to invest in new factories for developing offshore turbine components, floating platforms, cables, and other technologies.

Ahead of the Energy Security Summit in London with the International Energy Agency (IEA), the Prime Minister confirmed the funding ahead of this summer’s Comprehensive Spending Review.

The investment will directly and indirectly mobilise billions in additional private investment, helping de-risk clean energy projects and supporting thousands of jobs. This public investment complements the £43 billion of private investment pledged for clean energy projects since July. The new supply chain fund is will to be open for applications by the end of the year, as the government aims to build out renewables supply chain capacity to support its goal of delivering a clean power system by 2030. The investment is part of the 2024 Industrial Growth Plan, in which the Offshore Wind Industry Council proposed to match fund £300 million of grant investment in the UK’s supply chains with private sector investment.

£300mn in Funding for UK Offshore Wind Supply Chains

UK Government and Eni have agreed to go ahead with the Liverpool Bay carbon capture (CCS) project

The UK government and Eni have reached financial close for the launch of the Liverpool Bay CCS project, paving the way to the construction phase. Following this, the National Sea Transition Authority (NSTA) has awarded three carbon storage permits to Eni.

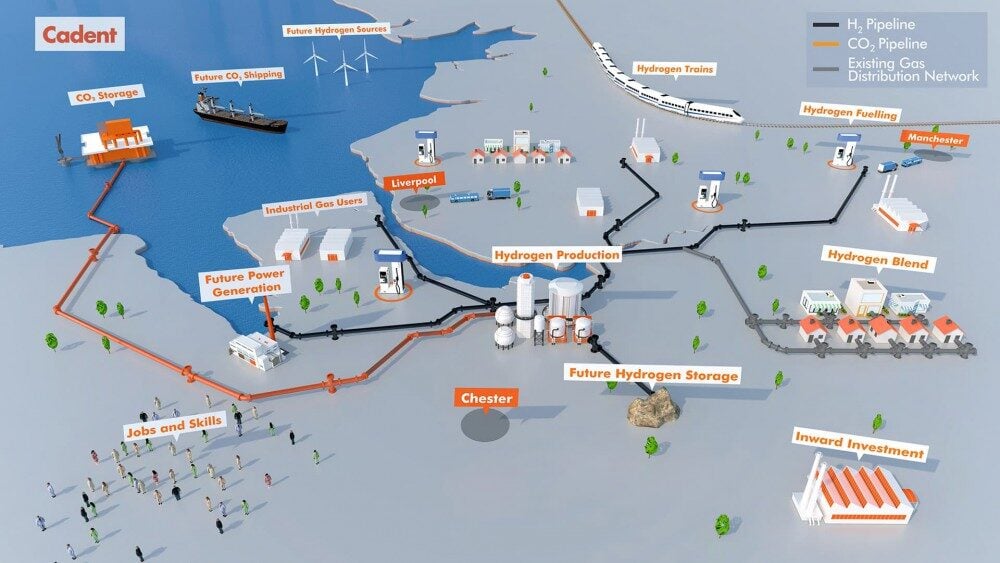

The Liverpool Bay project will be the backbone for the HyNet CCS Cluster, with Eni acting as the CO2 transport and storage system operator. Specifically, the HyNet Cluster will transport carbon dioxide from capture plants across the Northwest of England and North Wales through new and repurposed infrastructure to permanent storage in Eni’s depleted natural gas reservoirs located under the seabed in Liverpool Bay.

The project will involve repurposing part of the offshore platforms and 149 km of onshore and offshore pipelines, as well as the construction of 35km of new pipelines to connect industrial emitters to the Liverpool Bay CCS network. Phase one of HyNet aims to store 109 million tonnes of CO2 in the East Irish Sea, 20 miles off the coast of Liverpool, over 25 years. The project will initially have a storage capacity of 4.5 Mt of CO2 per year in the first phase, with the potential to increase to 10 Mt of CO2 per year in the 2030s.

Construction will begin this year, with a planned start-up in 2028, thus aligning with industrial emitters in the HyNet Cluster. Moreover, the construction phase alone will create 2,000 new jobs, and Eni expected to award around £2 billion in supply chain contracts.

Green light given for Liverpool Bay CCS project

Subscribe for the latest updates